News for Investors

Tata Chemicals in Spotlight as speculation over Tata Sons IPO Looms

The market has been closely watching Tata Chemicals, witnessing a remarkable rally that saw its share price soar by nearly 40% over six days, peaking with a 7% jump on March 7th. This surge is tied to the company's significant stake in Tata Sons.

Crypto

Bitcoin's Remarkable Surge Above $60,000: A Confluence of Confidence and Anticipation

Institutional interest from U.S. investors has been particularly pronounced, driving the rally with significant trading activity concentrated during U.S. market hours. This shift is indicative of a larger trend of institutional adoption.

Equities

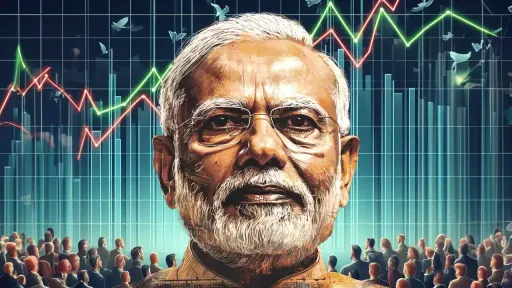

India's BSE Sensex Index Forecasted to Surge 9% in 2024 Amid Economic Optimism

India's BSE Sensex index, a barometer for the country's stock market health, has shown remarkable resilience and growth potential. Following a nearly 19% climb in the previous year, the index breached the 73,000 mark for the first time in January 2024.