Quantum Stocks Are Set to Crash — Here’s Why the Valuation Bubble Can’t Last

The quantum computing sector is experiencing one of the most dramatic rallies in recent memory — a surge that has lifted several stocks by thousands of percent in under a year. But behind the hype and futuristic promises lies a stark reality: valuations have drifted far beyond reason, fundamentals are deteriorating, and insider confidence is evaporating.

The setup looks uncannily like every speculative bubble before it. The only question investors are asking now is when it bursts.

A 3,000% Rally That Defies Logic

Over the past year, shares of quantum computing firms such as Rigetti Computing (RGTI), IonQ (IONQ), D-Wave Quantum (QBTS), and Quantum Computing Inc. (QUBT) have delivered astronomical returns — in some cases exceeding 3,000%.

Fueled by social media buzz, retail enthusiasm, and the broader artificial intelligence boom, the sector has become a magnet for speculative capital. But the disconnect between price and performance has reached levels not seen since the dot-com bubble of the early 2000s.

Valuations Detached From Reality

By any measure, the numbers don’t add up. Quantum computing stocks are trading at multiples of 200x to 900x forward sales, far surpassing even the most excessive valuations of the dot-com era.

Collectively, these companies boast a market capitalization of over $40 billion, while their combined trailing twelve-month revenue remains under $100 million. That translates to an industry-wide price-to-sales ratio of roughly 400x.

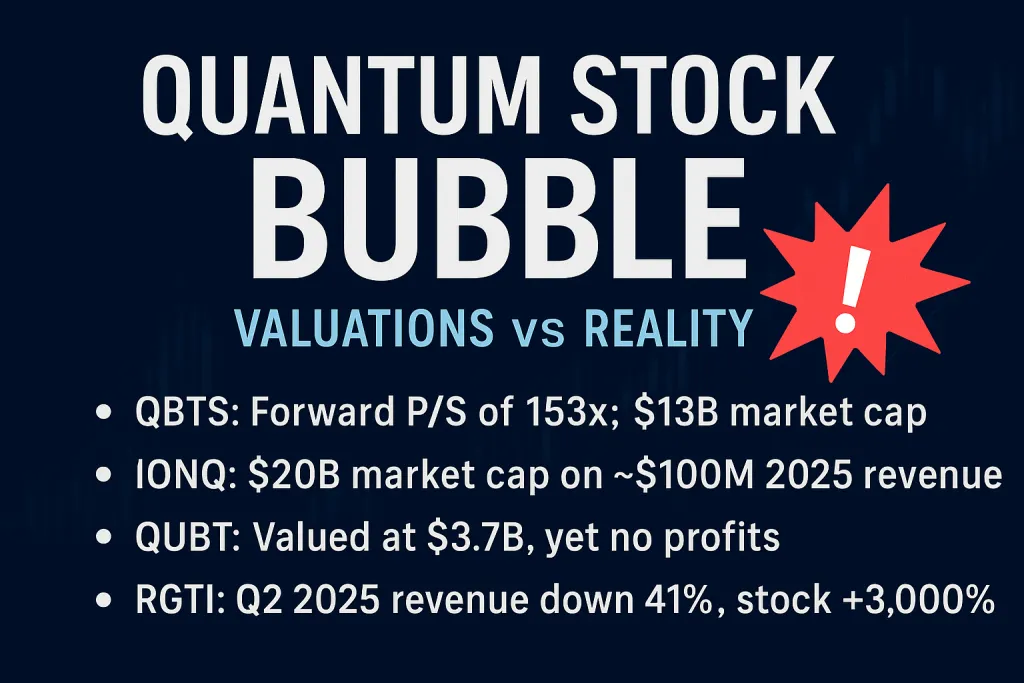

Let’s break that down:

QBTS (D-Wave Quantum): Trades at a forward P/S of 153x, with a market cap of around $13 billion despite trailing revenue of just a few million. In Q2 2025, the company reported $3.1 million in revenue, up 42% year-over-year but sharply lower than its one-time $15 million system sale in Q1.

IONQ: Carries a $20 billion market cap on roughly $100 million in projected 2025 revenue — implying a 200x price-to-sales multiple.

QUBT: Valued at $3.7 billion, even though it continues to report no profits.

RGTI (Rigetti Computing): Reported Q2 2025 revenue of $1.8 million, down 41% year-over-year, yet its stock has surged more than 3,000% in 2025 alone.

These valuations are not just high — they’re unprecedented for companies generating so little revenue and facing years of uncertainty before profitability.

Insiders Are Cashing Out

Adding fuel to investor concerns, Rigetti’s CEO Subodh K. Kulkarni sold all of his personal holdings earlier this year. In May 2025, he exercised options for 1 million shares and sold them immediately, leaving him with zero ownership in the company.

That move, highlighted by Benzinga, has not gone unnoticed. Investors are questioning why the CEO of a company supposedly on the verge of a quantum revolution has no skin in the game.

Insider selling at a time of retail euphoria is often a red flag — one that historically precedes sharp corrections.

A Promising Technology Still in Its Infancy

None of this is to say that quantum computing lacks potential. The technology could revolutionize fields like cryptography, drug discovery, and logistics optimization. But commercial adoption remains years, if not decades, away.

Most revenue across the sector comes from research contracts, pilot programs, or one-off system sales, not recurring enterprise deals. That makes the current valuations speculative at best — and unsustainable at worst.

The Question Is When, Not If

Every bubble follows a pattern:

Exciting new technology captures investor imagination.

Early gains attract retail momentum and media attention.

Valuations decouple from underlying performance.

Insiders exit while late entrants fuel the final leg of the rally.

Reality sets in, and prices correct — often violently.

Quantum computing stocks now fit that script perfectly. Whether the correction begins this quarter or next year depends largely on liquidity, market sentiment, and the patience of retail traders.

But with interest rates high, institutional caution growing, and insider confidence fading, the crash appears less like a question of if and more like when.

Quantum computing may very well reshape the world — but the market is acting as if that future is already here.

When companies with $1–3 million in quarterly revenue trade at billion-dollar valuations, it’s not innovation being priced in; it’s speculation. The sector’s aggregate price-to-sales ratio of nearly 400x is unsustainable by any rational metric.