Tips to Recover from a Big Trading Loss

In a volatile market, individuals may encounter unexpected and substantial trading loss, which can significantly erode their confidence. The events of 2022 served as a clear testament to the prevalence of anxiety in the financial markets, with rampant inflation and subsequent policy adjustments by the Federal Reserve amplifying market volatility. While such volatility can present lucrative opportunities for substantial gains, it also exposes traders to substantial risks and potential losses.

Investors across the board have experienced the challenging task of regaining their confidence following significant setbacks in the past year’s demanding market conditions. For those who find themselves hesitant to re-engage in trading, a comprehensive seven-point strategy is recommended to facilitate a smoother reentry into the market.

7 Tips to Recover from a Big Trading Loss

Below are 7 tips which helps you recover from a big trading loss:

#Tip 1: Learn from your mistakes

Successful traders demonstrate the ability to identify and acknowledge their strengths and weaknesses, effectively incorporating this awareness into their trading strategies. They understand the significance of conducting a comprehensive post-trade analysis following any loss, regardless of its magnitude. Such an analysis serves to gain insights into potential shortcomings in research or decision-making driven by emotions.

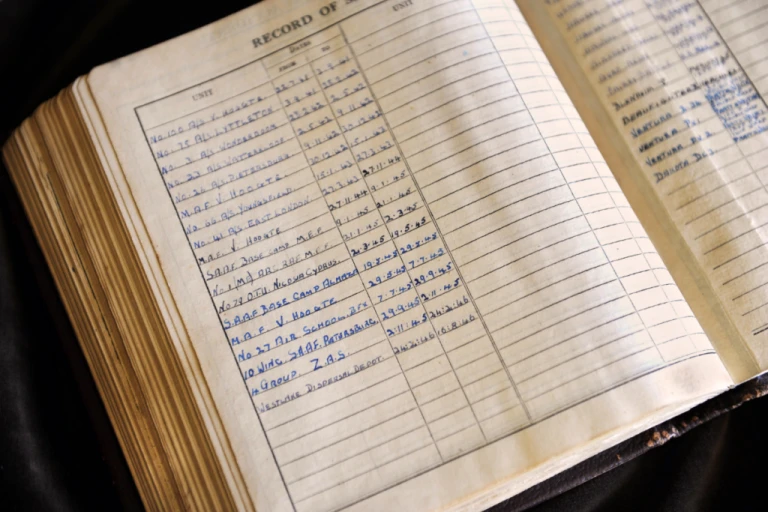

#Tip 2: Maintain trade logs

In the pursuit of optimizing trading performance, it is essential to meticulously track all trading activities to discern successful approaches from those less fruitful. A diligent trader maintains a comprehensive and organized spreadsheet documenting every trade executed. This record encompasses fundamental details such as order entry and exit dates, as well as realized gains and losses. Additionally, a noteworthy component of this log is a section designated for recording reflections on the factors contributing to either favorable outcomes or unfavorable results. This analytical aspect proves to be of paramount significance, as the trader regularly refers back to it when evaluating similar trades or assessing novel trading concepts. The systematic maintenance of such a detailed and insightful log aids in making informed decisions and refining trading strategies over time.

#Tip 3: Writing off

One advantageous aspect of experiencing investment losses is the opportunity to utilize them as a means to counterbalance capital gains or ordinary income, a practice commonly known as “writing off” losses. Employing this tax-smart strategy allows investors to offset taxable gains, thereby potentially reducing their overall tax liability. Apart from the evident tax benefits, acknowledging that one can leverage a loss to save on taxes can offer a sense of consolation and contribute to an enhanced sense of morale. This understanding empowers investors to view losses from a more pragmatic perspective, recognizing that they can play a constructive role in their financial planning and taxation strategies. As a result, investors are motivated to approach their investment decisions with a well-rounded perspective, considering both potential gains and the associated tax implications.

#Tip 4: Start off slowly and confidently

In the process of rebuilding after a significant setback, it is essential to adopt a cautious and methodical approach rather than hastily diving back into trading. The recommended strategy involves starting with smaller positions compared to previous practices. The emphasis lies in accumulating a series of incremental wins to reinforce the trading strategy and bolster one’s confidence. By implementing this gradual reentry, the trader aims to mitigate potential risks and uncertainties. This well-considered method allows for a step-by-step reaffirmation of skills and ensures a more stable and confident foundation for future trading endeavors.

#Tip 5: Scale up and scale down

In a strategic approach to position management, traders may consider the method of scaling up or scaling down their investments. Rather than immediately purchasing a large number of shares for a new position, a cautious approach involves initiating the position with a smaller quantity and subsequently increasing the stake when opportune moments arise, especially during price dips. Similarly, when dealing with a profitable position, the trader can opt for a gradual scaling-down process by selling portions of the winning position at different intervals, rather than liquidating the entire holding in one go. This measured approach to scaling aims to optimize risk management and capitalize on favorable market conditions while maintaining a well-calibrated and prudent trading strategy.

#Tip 6: Using limit and stop orders

Limit orders and stop orders are valuable tools in a trader’s arsenal, offering precise control over buy and sell transactions. A limit order enables the trader to stipulate the highest price they are willing to pay for a purchase or the lowest price they are ready to accept for a sale. This ensures that the trade will only be executed if the specified price or a more favorable one is available in the market. On the other hand, stop orders transform into market orders once the price surpasses a predetermined level. However, such orders do not guarantee a specific execution price, as market conditions can fluctuate rapidly, impacting the order’s fulfillment. These mechanisms serve as a means to curb impulsive decisions. But traders must remain aware of the dynamic nature of stock prices and availability. Which may influence the final outcome of their orders.

Also read: What is capital Investment? How it works?

#Tip 7: Seeking expert advice

It is prudent to seek a second opinion and consult with financial professionals to gain valuable insights into the complexities of the financial markets. Engaging with experts allows individuals to make well-informed decisions based on diverse perspectives and expert analysis. Accessing professional assistance provides a reliable source of guidance and can lead to better financial outcomes. By leveraging the expertise of professionals, individuals can navigate the markets with confidence and develop strategies that align with their unique financial goals.

Also read: Will Web3 help investing better and be accessible?

The bottom line

In conclusion, recovering from a significant trading loss requires a combination of self-reflection, strategic planning, and seeking expert advice. By learning from past mistakes and maintaining detailed trade logs. Traders can better understand their strengths and weaknesses, allowing them to refine their strategies. Leveraging tax benefits and employing limit and stop orders provide essential tools for risk management and preventing impulsive decisions. Gradually scaling up or down positions enables traders to optimize risk exposure during market volatility. However, perhaps the most valuable aspect of recovery lies in the willingness to seek expert guidance. Consulting with financial professionals offers a well-rounded perspective, providing valuable insights and fostering informed decision-making. By following these seven tips, traders can pave the way for a smoother and more confident journey towards regaining financial stability and success in tumultuous markets.

Follow us on instagram.