Memory Chip Supercycle Divides Winners and Losers: PC Giants Sink as Suppliers Soar 400%

The non-stop surge in memory chips has just made a difference between those who won and those who lost in the stock market, and it's coming in like a huge wave that seems to cover the sky itself.

Big PC brands, Apple Inc. to Nintendo Co. and the rest of the company's suppliers are seeing shares slump to the point there are profitability concerns. Meanwhile Memory producers are soaring to unprecedented heights. Money managers and analysts are assessing which firms can best walk through this tight alley by locking in supplies, raising product prices or redesigning to use less memory.

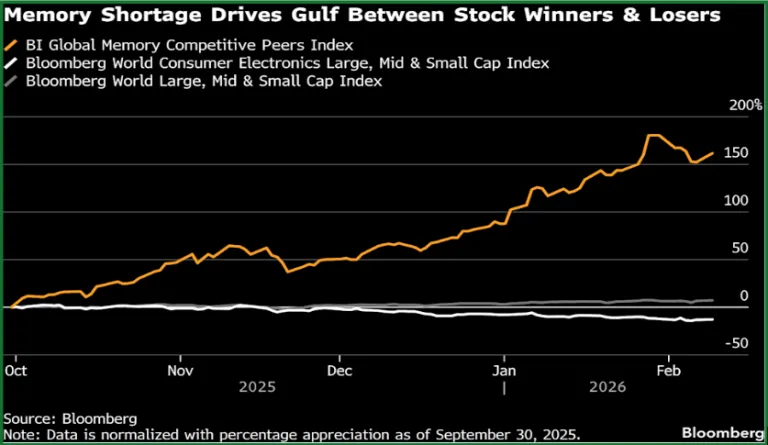

According to Bloomberg gauge of global consumers, electronics makers are going down 10% since the end of September while a basket of memory makers not to exclude Samsung Electronics Co. has surged roughly 160%. The focus now shifts to assessing how much of this is reflected in the current pricing.

“What remains underappreciated is the risk around duration - current valuations largely factor in that the disruption will normalize within one to two quarters,” said Vivian Pai, a fund manager at Fidelity International. So investors that are in for the long run should pay attention. “We believe industry tightness is likely to persist,” possibly through the rest of the year, she added.

Memory chip shortages and pricing are being mentioned frequently by companies in earnings reports and conference calls. Without a doubt memory chips are a big concern for these companies. In one of the latest examples, Honda Motor Co. noted Tuesday that supply risks are emerging for memory components.

In the volatile world of semiconductors, few issues have gripped investors' attention quite like the escalating memory chip shortage. PC manufacturers, long the backbone of consumer electronics, are bearing the brunt of this crisis. Powerhouses such as Lenovo Group Ltd. and Dell Technologies Inc. have seen their stock prices plummet more than 25% from their October peaks, erasing billions in market value amid fears of eroding profitability.

The pain isn't confined to traditional PC builders. Even peripheral specialists like Swiss-based Logitech International SA, known for its mouses, keyboards, and webcams, have suffered a staggering nearly 30% drop from November highs. Investors worry that ballooning chip costs, particularly for DRAM and NAND flash memory, will crimp demand for PCs and accessories as consumers tighten their belts and companies delay upgrades.

This unease has rippled far beyond desktops and laptops. Shares in Chinese tech titans, including electric vehicle leader BYD Co. and smartphone innovator Xiaomi Corp., have languished amid similar supply chain jitters. For these firms, memory chips are critical components in batteries, displays, and processing units, and any prolonged shortage threatens production ramps and market share gains.

“Memory prices have evolved from a niche discussion to a dominant headline this earnings season,” observes Charu Chanana, chief investment strategist at Saxo Bank. While the market has largely absorbed the reality of rising prices and constrained supply, fresh doubts are emerging about the crisis's duration. “That’s no longer novel information...it’s priced in,” Chanana notes. “But the timeline for resolving this tightness is now under scrutiny, introducing new uncertainty.”

Compounding these demand worries are seismic shifts in the memory chip ecosystem, fueled by the explosive growth of artificial intelligence. U.S. hyperscalers, tech behemoths like Amazon.com Inc., Microsoft Corp., and Google (Alphabet Inc.) are pouring tens of billions into AI data centers. This infrastructure frenzy prioritizes high-bandwidth memory (HBM), a specialized DRAM variant essential for training massive AI models like those powering ChatGPT or image generators.

The result? A diversion of precious production capacity away from conventional DRAM used in PCs, smartphones, and EVs. Major suppliers such as Samsung Electronics Co., SK Hynix Inc., and Micron Technology Inc. have reallocated fabs to chase lucrative HBM contracts, leaving everyday memory in short supply. Prices for DDR4 and DDR5 DRAM have surged 20-50% in recent months, with NAND flash following suit.

Analysts are dubbing this a "memory supercycle" a rare, sustained boom that defies the industry's notorious boom-bust cycles. Historically, memory markets swing wildly: gluts lead to price crashes, oversupply corrects to shortages, and vice versa. But AI's insatiable hunger, projected to consume 20-30% of global DRAM capacity by 2025 according to TrendForce, could prolong the upswing well into 2026 or beyond.

For corporate earnings, the implications are stark. Dell and Lenovo, already grappling with post-pandemic PC slumps, face margin squeezes as they pass on costs or eat them to stay competitive. Logitech's woes highlight broader ecosystem risks, while BYD and Xiaomi contend with U.S. - China trade frictions amplifying supply vulnerabilities.

Wall Street is divided. Optimists point to ramping fab investments Samsung's $230 billion commitment to new plants, for instance as harbingers of relief. Pessimists warn that AI demand will outpace supply growth, potentially inflating prices further.

As earnings reports roll in, investors will parse guidance closely for clues on inventory builds and pricing power. For now, the chip crunch serves as a stark reminder of technology's interconnected fragility: a single bottleneck in South Korea or Taiwan can cascade globally, humbling even the mightiest firms.

Spot prices for DRAM have shot up more than 600% in the past few months, even as demand for end products like smartphones and cars are still weak. On top of that, AI is reading new demand for NAND chips and other storage products, driving up costs in those segments as well.

As such, memory chip makers have been the standout winners among tech stocks. Shares of SK Hynix Inc., a key supplier of HBM to Nvidia Corp., are up more than 150% just since the end of September in Seoul. Among makers of more normal chips, Japan’s Kioxia Holdings Corp. and Taiwan’s Nanya Technology Corp. are up over 270% each in that span, while Sandisk Corp. has climbed more than 400% in New York.

According to Jian Shi Cortesi, a fund manager at GAM Investment Management in Zurich, she has been holding memory chip shares “Historically the memory cycle normally lasted 3 to 4 years, the current cycle already exceeded the previous cycles both in length and magnitude, and we are not seeing demand momentum softening.”