Crypto Wallet – How to effectively use a Crypto Wallet?

Cryptocurrency is the trending topic these days, I’m sure you have heard of this. But how do you store it, where to keep it safe? In this blog post, we will show you how to effectively use a crypto wallet. We will also explain the different types of wallets and how to choose the right one for you.

What is a crypto wallet?

The term “wallet” is a bit misleading because crypto wallets do not store cryptocurrency in the same way that physical wallets do. Instead, they read the public ledger to show you the balances in your addresses, as well as the private keys that allow you to conduct transactions.

Cryptocurrency wallets store users’ public and private keys while also providing an easy-to-use interface for managing crypto balances. They also facilitate cryptocurrency transfers via the blockchain. Some wallets even allow users to interact with decentralised applications or buy and sell crypto assets (dapps).

The importance of crypto wallet

Your cryptocurrency is only as secure as the method you use to store it. While you can technically store cryptocurrency directly on the exchange, it is not recommended unless you are doing so in small amounts or plan to trade them frequently.

It is recommended that you withdraw the majority of larger amounts to a crypto wallet, whether hot or cold. You retain ownership of your private keys and full power and control over your own finances in this manner.

Public and private wallets

When you want someone to send you cryptocurrency, you give them your public wallet address. Anyone can look up your address and see how much money you have and your previous transactions. However, because the address is simply a string of numbers and letters, your holdings and transactions are anonymous unless someone knows it belongs to you. Many people are drawn to cryptocurrencies because of their transparency and anonymity.

Cryptocurrency owners do not publish or give their private wallet address to anyone. Giving someone the password to your email account or a password-protected document containing personal information would be equivalent. To sign off on transactions, the private key is used. Someone who has access to both your public and private keys now has control over your holdings. However, because of the way they’re encrypted, the chances of a hacker matching up potential public and private keys are extremely unlikely.

Types of Crypto Wallets

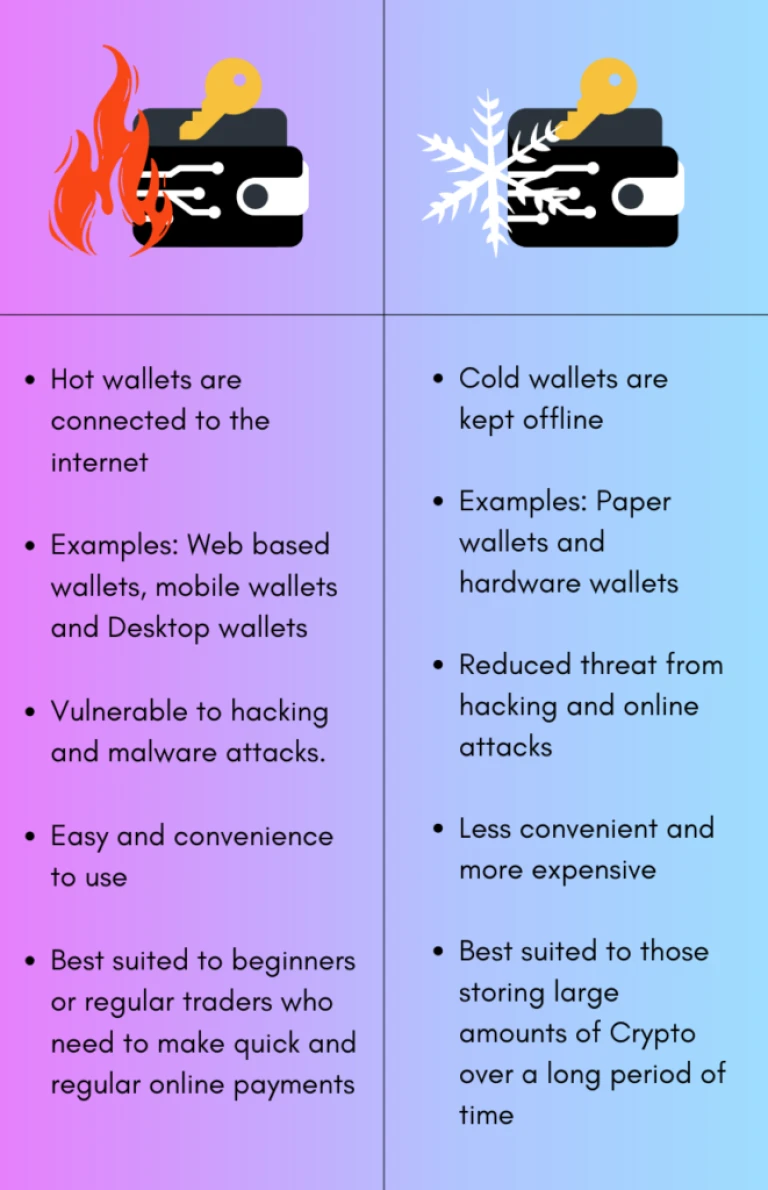

Mainly there are two types of Crypto Wallets – Hot wallets and cold wallets. Read on to learn about the different types of cryptocurrency wallets, and which is best for you and your needs.

Hot Wallets and cold wallets

Hot wallets

When you choose to store your holdings with a cryptocurrency exchange, the exchange uses what is known as a “hot wallet.” It’s hot because it’s always connected to the internet — always online, hot with electricity. This means that funds stored in hot wallets are more accessible and thus easier to gain access by hackers.

Private keys are stored and encrypted on the app itself, which is kept online, in hot wallets. Using a hot wallet can be dangerous because computer networks contain hidden vulnerabilities that hackers or malware programs can exploit to gain access to the system. Keeping large amounts of cryptocurrency in a hot wallet is a fundamentally bad security practices; however, the risks can be mitigated by using a hot wallet with stronger encryption or devices that store private keys in a secure enclave.

Examples of hot wallets include:

- Web-based wallets

- Mobile wallets

- Desktop wallets

Cold Wallets

Cold wallets exist in the offline world and can take the form of a physical hardware device or a piece of paper. They are not as convenient as hot wallets, but they are far more secure. An example for Cold wallet is that you can simply write down your public and private address on a piece of paper and use that to recover your funds.

Hot Wallets vs Cold Wallets: Which is Better?

Both Hot and Cold wallets have their own advantages and disadvantages, , the option you choose will depend on what you are looking for.

Paper Wallets

A physical location where the private and public keys are written down or printed is referred to as a paper wallet. In many ways, this is safer than storing funds in a hot wallet because remote hackers cannot access these keys, which are protected from phishing attacks. On the other hand, it raises the possibility of the piece of paper being destroyed or lost, resulting in irrecoverable funds.

Hardware wallets

One type of wallet that is gaining popularity is the hardware wallet. A hardware wallet is a physical device that stores your private keys and allows you to sign transactions offline. Hardware wallets are one of the most secure type of wallets available and are a good option for storing large amounts of cryptocurrencies.

If you are considering using a hardware wallet, there are a few things to keep in mind. First, make sure to buy a reputable brand such as Ledger or Trezor. These companies have been around for awhile and have built up a good reputation in the space. Second, be sure to backup your device and keep your recovery seed in a safe place. This will ensure that if your device is lost or stolen, you will still be able to access your funds. Finally, always remember that no matter how secure your wallet is, it is only as secure as the person who holds the private keys. So be sure to take extra precautions with your security if you plan on using a hardware wallet.

Custodial wallets and Non custodial wallets

Custodial wallets

A Custodial Wallet is defined as a wallet in which the private keys are held by a third party. Meaning, the third party has full control over your funds while you only have to give permission to send or receive payments. The main distinction between custodial wallets and the other types is that users no longer have complete control over their tokens, and the private keys required to sign transactions are only held by the exchange.

Non custodial wallets

Non-custodial wallets, on the other hand, allow you to retain full control of your funds since the private key is stored locally with the user. This implies that users have full control over their funds and on the associated private key. Note that hardware wallets are inherently non-custodial since private keys are stored on the device itself.

Custodial wallets and Non custodial wallets – Which one is better?

- If you are prone to losing passwords and devices, a custodial wallet makes more sense, as an exchange or custodian is likely to have better security practices and backup options. As a result, it’s a popular choice for beginners with little to no experience trading cryptocurrency. Furthermore, transaction fees with a custodial wallet are typically lower or even free.

- If you prefer to keep complete control over your funds, you should consider a non-custodial wallet.

Ultimately do you own research on what type of wallet you need and decide on one.

Multi-signature wallets

In some cases, having multiple levels of approval for spending cryptocurrencies is desirable. As the name implies, multi-signature wallets require transaction authorization via multiple keys, which means that a group of users must sign to approve a transaction.

- Multi-signature wallets, or “multisig wallets,” are a type of cryptocurrency wallet that requires at least two private keys to sign a transaction.

- There are several benefits to using a multi-signature wallet for your cryptocurrency transactions. First, it adds an extra layer of security, since all signers must approve of a transaction before it can be processed. This means that even if one private key is compromised, the funds in the wallet will remain safe. Second, it can help speed up transactions, since multiple users can sign off on a transaction simultaneously. And third, it can help you keep track of your spending, since all signatories will have a record of every transaction that takes place.

NFT wallets

NFT Wallets are essentially virtual wallets that store your NFTs. They work in a similar way to regular cryptocurrency wallets, but with a few key differences. For starters, NFT wallets are designed specifically for NFTs, which means that they can store and manage your NFTs in a more efficient and user-friendly way. In addition, NFT wallets typically offer more features and security options than regular crypto wallets, which is important given the unique nature of NFTs. Here are some things to consider when choosing an NFT wallet:

- Compatibility with NFT marketplaces – You’ll need a wallet that can connect to the NFT marketplaces where you want to buy.

- High security – Two-factor authentication

- Friendly user interface – A good NFT wallet should be simple to use and set up.

- Multi-device compatibility – Most NFT wallets are available as web extensions, mobile or desktop applications, or both. Look for a wallet that can synchronise transactions in real time and is available on multiple devices for added convenience.

- Compatibility across chains – Most wallets support Ethereum-based tokens, but if you want to mint, buy, and sell tokens on other networks, you’ll need a wallet that supports cross-chain transactions.

Which Crypto Wallet should you use?

There is no perfect solution for cryptocurrency wallets. Each type of wallet has distinct advantages, functions, and trade-offs. So it’s really up to you to decide what’s best for you and your specific requirements. However below are some factors to consider :

- Software vs hardware

- Security features

- How user-friendly it is

- Fees

- Supported coins

- Platform compatibility

- Whether you need dApp and DEX integration

- Whether the wallet has backup options

- The wallet’s reputation and longevity on the market

Follow us on Instagram