How to survive a Bear Market?

For investors, a bear market can be a scary time. The value of stocks falls and it can feel like your portfolio is hemorrhaging money. But if you take a few deep breaths and follow these tips, you can survive (and even thrive) during a bear market.

What is a Bear Market?

A bear market is defined as a decline in the stock market of at least 20%. It is important to note that a bearish market does not necessarily mean that the economy is in trouble. Rather, it is simply a reflection of investor sentiment.

There are three main types of bear markets: primary (long-term), secondary (intermediate-term), and tertiary (short-term).

Primary bear markets are typically caused by a fundamental shift in the economy. For example, the dot-com bubble burst of the early 2000s was caused by a change in technology. Secondary bear markets are usually caused by factors such as interest rate hikes or geopolitical events. The 2007-2008 financial crisis was an example of a secondary bear market. Tertiary bear markets are typically much shorter in duration and are caused by factors such as corrections or changing investor sentiment.

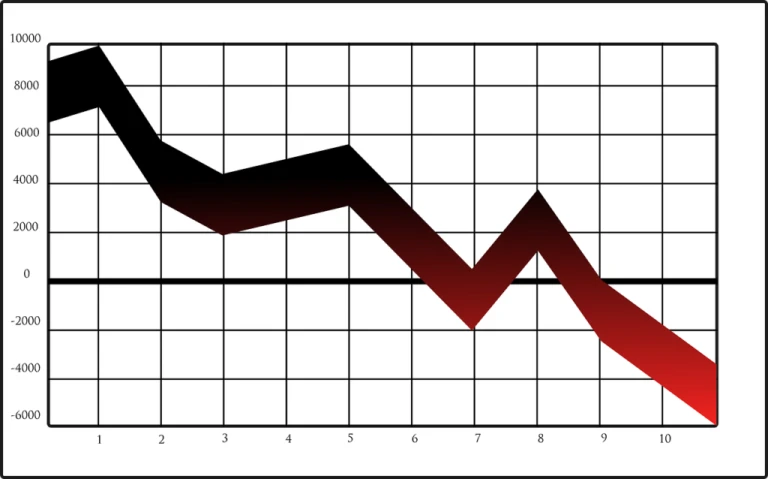

Prices go down during a Bear Market

Prices go down during a Bear MarketHow to invest in a Bearish Market?

When the stock market starts to head south, it can be a scary time for investors. But if you know how to invest in a bearish market, you can actually take advantage of the situation and make some money.

Here are a few tips on how to survive a bear market:

- Stay invested – don’t panic and sell everything.

- Consider buying stocks that are down – they may be a bargain.

- Focus on quality investments – don’t chase after penny stocks.

- Have cash on hand – this will give you the flexibility to buy when prices are low.

- Stay disciplined – don’t let emotion dictate your investment decisions.

What assets do well in a Bear Market?

In a bear market, investors tend to flock to safe-haven assets such as gold, silver, and Treasury bonds. These assets are seen as a store of value and a way to preserve capital during times of market turmoil. Other assets such as commodities and stocks can also do well in a bear market if they are considered to be undervalued. When selecting assets to hold during a bear market, it is important to consider both the upside potential and the downside risk.

How long does a Bear Market last?

The duration of a bear market is difficult to predict, as it is reliant on various factors such as the state of the economy and investor confidence. However, typically, a bear market lasts for around 18 months.

During this, stock prices fall and investors lose confidence in the markets. To survive a bear markets, it is important to have a plan and to be patient.

How do you prepare for a Bearish Market?

This is a period of time in which the stock market declines. Typically, it occurs when the Dow Jones Industrial Average falls by 20% or more from its previous high.

There are a few things you can do to prepare for such a market:

- Review your investment mix and make sure you’re diversified. This means having a mix of stocks, bonds, and cash so that you’re not overly exposed to any one asset class.

- Consider your risk tolerance. Are you comfortable with the possibility of losing money in the short term? If not, you may want to adjust your investment mix to be more conservative.

- Have a plan for selling investments if the market falls. This way, you won’t be tempted to sell at a loss out of panic.

- Stay informed about what’s happening in the markets. This way, you’ll be less likely to make impulsive decisions based on fear or greed.