ETFs vs Mutual Funds – A better Investment Option

Investing in mutual funds and exchange-traded funds (ETFs) can be a great way to grow your money. But, which is the better option for you? It’s important to understand the differences. Mutual funds vs ETFs before making any investment decisions. In this blog post, we will explore the pros and cons of both mutual funds and ETFs, so you can decide which one is the best fit for your goals. We’ll also take a look at how these different investment options can help you reach financial freedom. Let’s dive in!

What is an Exchange Traded Fund?

An ETF, or exchange-traded fund, is a stock exchange-traded investment fund. Commodities, stocks, and bonds are the types of securities held by an ETF. These are exchanged for Commodities, stocks, and bonds are the types of securities held by an ETF. During the trading day, these are traded for a price close to the asset’s original total asset value. The majority of ETFs track a bond or stock index. The ETF’s price can fluctuate throughout the day.

ETFs typically have lower fees and higher daily liquidity than mutual fund shares. ETFs can be used for a variety of purposes, including hedging, equitizing cash, and arbitrage. ETF shareholders receive a small portion of the profits earned, such as dividends and interest. They may also receive a portion of the fund’s remaining value if the fund is liquidated. Because ETF shares are primarily traded on public stock exchanges, they can be easily transferred, bought, or sold in the same way that stock shares can.

ETF supply is generated through the creation and redemption processes, which involve some special investors known as authorised participants (APs). APs are primarily well-known financial institutions with significant purchasing power, such as banks and investment firms.

The following are the main advantages of ETFs:

- Investors can either sell short or buy on margin. They can also purchase one share because there is no minimum investment requirement.

- The commission paid to the broker when buying or selling ETFs is the same as the commission paid for regular orders.

- It is similar to a mutual fund in that it can be bought and sold at varying prices throughout the day. The transactions are also carried out in real time.

What is a Mutual Fund?

A mutual fund is a type of financial vehicle that pools money from various investors to invest in securities such as stocks, bonds, money market instruments, and other types of assets. Mutual funds are managed by experts who allocate the assets of the fund in order to maximise capital or income for the fund’s investors. The portfolio of a mutual fund is created and maintained to meet the investment objectives stated in the prospectus.

Mutual funds provide individual investors with access to professionally managed portfolios of stocks, bonds, and other securities. As a result, each shareholder shares in the fund’s profits and losses proportionally. Mutual funds invest in a diverse range of assets, and performance is typically measured as the change in the fund’s net market cap, which is determined by aggregating the performance of the underlying investments.

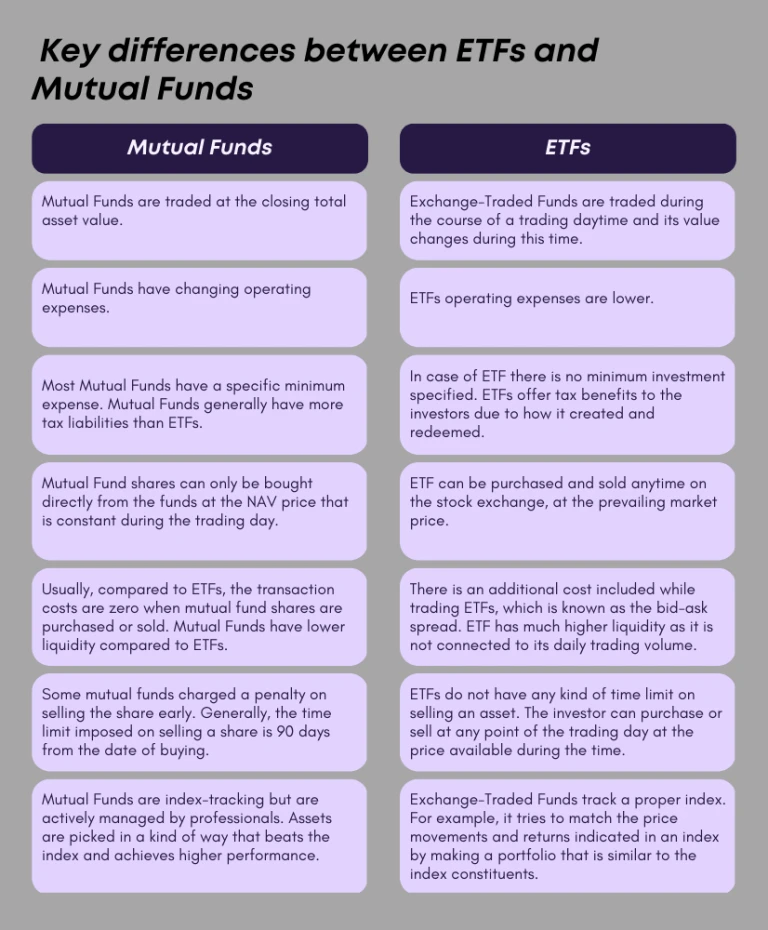

ETFs vs Mutual Funds – Key Differences

Similarities between ETF and Mutual Fund

Diversified structure

Both of these funds are made up of a basket of securities purchased with money pooled together from each investor.

Professional management

Expert managers or management companies oversee ETFs and mutual funds. Mutual funds and ETFs can both be actively or passively managed. Though ETFs are more commonly passively managed to track an index.

Variety of Choice

ETFs and mutual funds both allow investors to access a wide range of asset classes. Including stocks, bonds, commodities, cash-equivalent securities, or a combination of these.

ETF vs Mutual Funds: Which one is better?

If you want to build a well-diversified investment portfolio, both of these options can help you. However you can choose which one is better based on your time frame, risk tolerance, and financial goals. Some investors prioritised liquid investments over long-term investments. While the nature of both of these funds is very similar and they both provide a diversified investment portfolio. A healthy and wise mix of ETFs and mutual funds can benefit your investment record. However, before you take any action, make sure you understand the functionality of both of these funds, assess the market risks you’re willing to take, and consult with a professional to ensure you’re making the best investment decision for yourself.

Follow us on Instagram.