How is Currency Valued?

Do you know how currency is valued? It’s a question that seems simple enough, but the answer is actually quite complicated. And, it’s a topic that is often shrouded in mystery for the average person. In this blog post, we will attempt to demystify how currency is valued. We will explore topics such as inflation, interest rates, and trade imbalances to better understand how these things impact the value of the currency. By the end of this article, you should have a firmer grasp of how currency valuation works.

What is Currency?

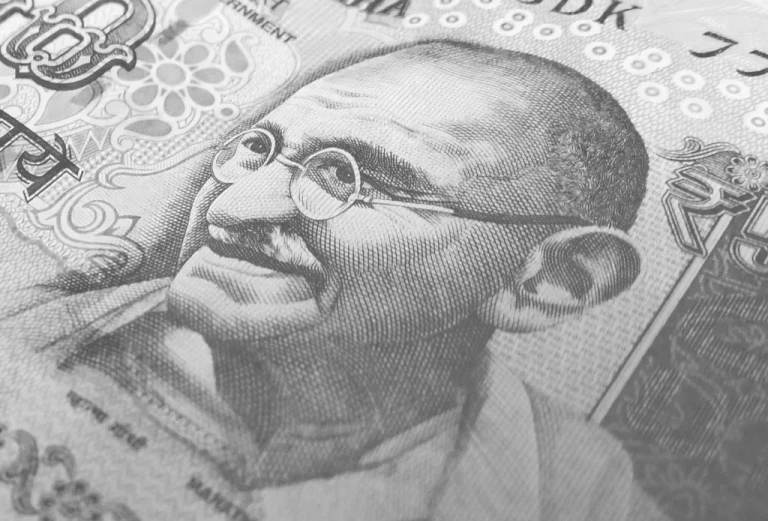

Currency is any form of money that is in circulation in a given economy. It can take the form of physical cash, such as coins and bills, or electronic funds, such as credit and debit cards. Central banks issue currency and oversee its supply and value.

The value of a currency is determined by the laws of supply and demand. The more people want to hold a particular currency, the higher its value will be. Conversely, if there is less demand for a currency, its value will decrease. Factors that can influence the demand for a currency include a nation’s economic stability, interest rates, inflation, and political stability.

What are the various forms of Currency that may exist?

Currency may exist in various forms, including paper money, coins, electronic money, and banknotes. The value of a currency depends on factors such as inflation, supply and demand, and political stability.

What factors affect the way Currency is valued?

Currency valuation is a complex process that is affected by a variety of factors, including inflation, interest rates, and international trade. Inflation is the most important factor in determining the value of a currency. Interest rates also play a role in currency valuation, as they affect the amount of money that is available for investment. International trade also affects currency values, as currencies must be exchanged in order to conduct international business.

How is Currency Valuation done?

There are a few different ways that currency valuation is done. The most common method is through the use of exchange rates. Exchange rates can be used to value currency by taking the current exchange rate and multiplying it by the amount of currency you have. For example, if you have $100 USD and the current exchange rate for EUR/USD is 1.18, then your $100 USD is worth €118 EUR.

Another way to value currency is through the use of purchasing power parity (PPP). PPP takes into account the prices of goods and services in different countries and uses them to estimate the value of a currency. For example, if a Big Mac costs $4 USD in the United States and €3 EUR in France, then according to PPP, one dollar should be worth €0.75 EUR.

You can also value currency using interest rates. Interest rates can be used to value currency by taking into account the difference in interest rates between two countries. For example, if the interest rate in the United States is 3% and the interest rate in Germany is 0.5%, then according to this method, one dollar should be worth €6 EUR.

Finally, you can also value currency using GDP per capita. GDP per capita takes into account a country’s GDP divided by its population. This method values currency based on a country’s economic activity and output rather than on its prices or interest rates.