Best Index Funds for SIPs in India 2026: Top Picks & Performance

Index funds excel for SIPs in India in 2026 due to their low costs, passive tracking of proven benchmarks, and ability to capture broad market growth amid 7 percent plus GDP expansion. With expense ratios often below 0.3 percent and minimal tracking error, they outperform most active funds over 10 years while suiting disciplined monthly investing. This expanded guide ranks top performers across categories, drawing from latest 2026 data for Indian retail investors.

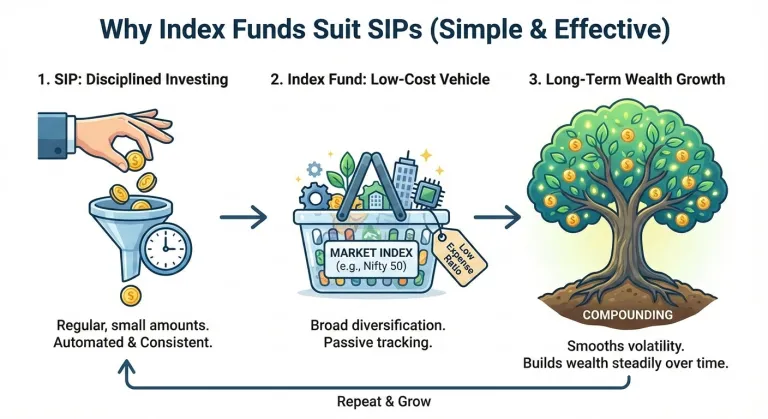

Why Index Funds Suit SIPs in 2026

Index funds mirror indices like Nifty 50 or Sensex, delivering benchmark returns minus tiny fees, making them ideal for rupee cost averaging during volatility.

Record SIP inflows hit new highs in 2025, signaling sustained equity participation into 2026 despite rupee pressure.

Low tracking error funds like those from HDFC and UTI ensure you get nearly full index upside, with 12 to 18 percent expected CAGR for large caps.

Top Nifty 50 Index Funds

These funds track India's top 50 companies, offering stability and 12 to 13 percent three year returns for conservative SIPs.

Fund Name | Expense Ratio | 1Y Return | 3Y Return | 5Y Return | AUM (Cr) |

|---|---|---|---|---|---|

HDFC Nifty 50 Index Direct Growth | 0.20% | 10.28% | 12.97% | 13.01% | High |

UTI Nifty 50 Index Direct Growth | 0.21% | 10.33% | 12.97% | 13.05% | 26,947 |

SBI Nifty Index Direct Growth | 0.44% | 10.24% | 12.98% | 13.01% | 9,839 |

ICICI Pru Nifty 50 Index Direct Growth | Low | 10.26% | 12.96% | 13.00% | Large |

Franklin India NSE Nifty 50 Index Direct Growth | Low | 10.37% | 12.96% | 12.92% | Solid |

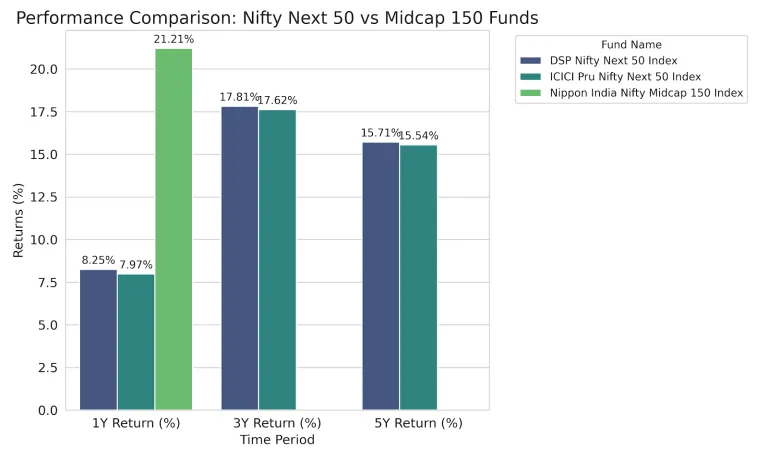

Nifty Next 50 and Midcap Leaders

For growth seekers, Next 50 funds target emerging giants with 17 to 18 percent three year returns, while Midcap 150 adds higher beta exposure.

Fund Name | Expense Ratio | 1Y Return | 3Y Return | 5Y Return | AUM (Cr) |

|---|---|---|---|---|---|

DSP Nifty Next 50 Index Direct Growth | Low | 8.25% | 17.81% | 15.71% | Growing |

ICICI Pru Nifty Next 50 Index Direct Growth | Low | 7.97% | 17.62% | 15.54% | Strong |

Motilal Oswal Nifty Midcap 150 Index | Low | High | N/A | N/A | 3,023 |

Nippon India Nifty Midcap 150 Index | 0.80% | 21.21% | N/A | N/A | 2,031 |

Global and Thematic Index Picks

Diversify with US tech or Nasdaq 100 funds for 20 to 30 percent returns, hedging rupee risks via international exposure.

Edelweiss US Technology Equity FoF leads with strong AUM at ₹3,640 Cr, capturing AI boom.

ICICI Pru Nasdaq 100 Index Fund delivers high single digit to double digit gains consistently.

SIP Strategy and Risks

Start SIPs with ₹5,000 monthly across 2 to 3 funds for diversification, reviewing annually but avoiding frequent switches. Equity indices suit horizons over 7 years; limit midcap to 30 percent allocation amid volatility. Past performance guides but consult advisors for personal fit, as market downturns test discipline.