How India’s FY26 Growth Outlook Will Play Out in the World Market

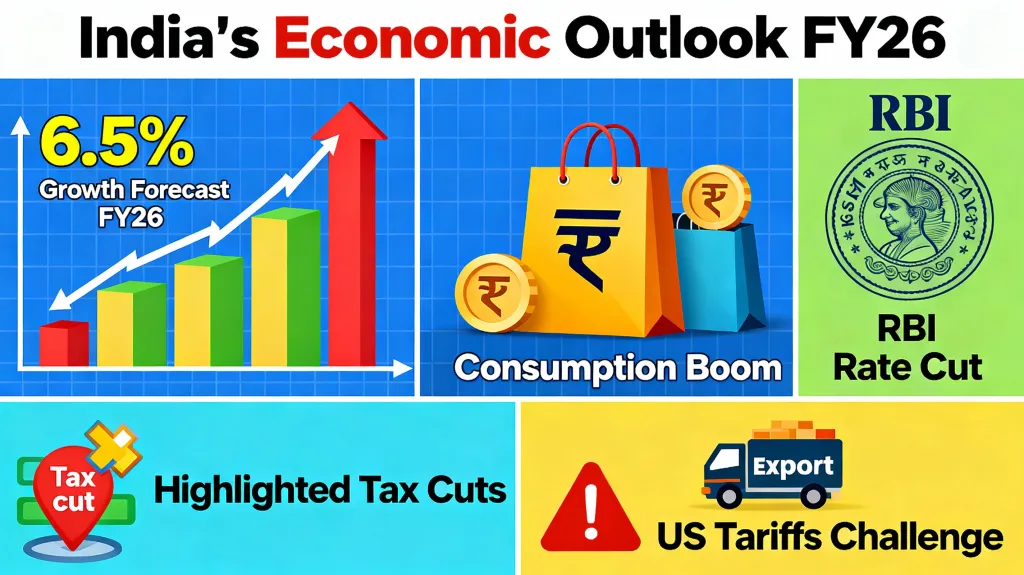

S&P Global’s decision to keep India’s FY26 growth forecast at 6.5%-supported by tax cuts, lower interest rates, and strong household demand-positions India as one of the fastest-growing major economies. This has several global spillover effects.

1. Impact on the World Market

a) India becomes a key global demand driver

Slowing growth in Europe and China means global producers are looking to India as the next major consumption market.

Strong household demand → Increased imports of electronics, luxury goods, machinery, and energy.

This lifts revenues for global companies exporting to India.

b) More stable global supply chains

Cheaper borrowing costs and tax incentives in India encourage:

Manufacturing expansion (electronics, autos, pharma)

Foreign companies increasing “China+1” (usually India, Vietnam, Malaysia) investments

This enhances global supply-chain diversification, reducing the world’s dependency on East Asia.

c) Attraction of foreign investment

A 6.5% growth trajectory makes India one of the most attractive destinations for capital flows.

More FDI and foreign portfolio inflows

Strengthens Indian equities’ presence in global indices

Boosts emerging-market investor confidence

When global investors trust one large emerging economy, risk appetite tends to improve across all EMs.

2. Effect on the USD–INR Exchange Rate

a) Supportive factors for a stronger INR

Lower RBI rates increase domestic consumption → higher economic activity

Tax cuts boost corporate earnings → foreign equity inflows

A strong, stable growth outlook → foreign investors buy Indian debt/equity

All these create demand for INR, offering support around current levels.

b) Why the INR may not strengthen sharply

Export challenges due to US tariffs reduce India’s dollar inflows.

Higher import demand (due to rising consumption) → increased USD demand

RBI tends to lean against excessive rupee appreciation to protect export competitiveness

So the impact is:

→ INR stays stable or moderately stronger

→ Volatility remains due to global USD strength cycles

Net Outcome:

A wide band of ₹88–90 per USD remains likely in the short term.

3. How Indian Consumers Will Influence the Global Economy

India’s consumption story is now globally relevant, similar to China a decade ago.

a) Global companies get a new growth engine

Rising income + cheaper goods due to tax cuts = higher spending on:

iPhones, electronics

Automobiles

Personal luxury (skincare, fashion)

Travel and hospitality

This creates a new global demand hub when others are slowing.

b) India shapes global price trends

With 1.4 billion people consuming more, India affects:

Energy prices (oil, LNG)

Food commodities

Industrial metals (copper, steel, aluminum)

Higher demand → firmer global prices, especially in energy.

c) Tech and services exports push global costs down

Even with export pressure from the US, India’s services sector stays strong.

Cheaper outsourcing

Competitive IT services

Global back-office operations

This helps lower global operating costs, benefiting world businesses.