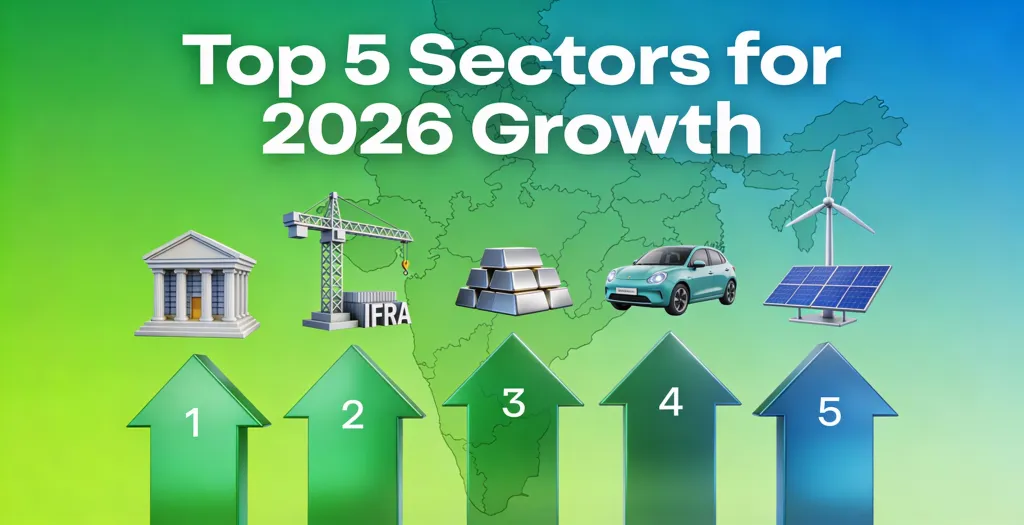

Top 5 Sectors to Watch for Explosive Growth in 2026

PSU Banks led with 27.77% YTD returns as of Dec 19, 2025, driven by asset quality improvements and credit growth. Metals followed at 21.63%, boosted by infra demand and commodity prices, while Auto hit 21.12% on domestic vehicle sales and EV momentum. Financial Services (16.44%) and Bank (16.14%) rounded out the top five, reflecting broad lending strength.

Green Fuel, EV, Power: Current Affairs & Supply Chains

Nuclear Power

Budget 2025-26 launched the Nuclear Energy Mission targeting 100 GW by 2047, with amendments to Atomic Energy Act for private participation. PHWRs (India's core tech) use natural uranium fuel (from domestic mines like Jaduguda/Tummalapalle or imports), heavy water (moderator), and graphite (structural). Heavy water produced by Heavy Water Board (govt), uranium mining via Uranium Corporation of India (UCIL, unlisted); no pure-play listed stocks, but power utilities like NTPC and equipment makers like Larsen & Toubro (L&T) benefit from reactor construction.

Green Hydrogen

NGHM(National Green Hydrogen Mission) allocation doubled to ₹600 crore, targeting 5 MMT(million metric tonnes) production by 2030 with ₹8 lakh crore investments; green ammonia up to 7.5 lakh tonnes. Process: Electrolysis of water using renewable power (solar/wind) splits H2O into hydrogen (fuel) and oxygen; raw materials include electrolysers (imported/domestic via PLI), platinum/iridium catalysts, and water (de-ionized). Stocks: Adani Green, Reliance Industries (electrolyser PLI winners), GAIL (transmission); no direct raw material plays listed yet.

EV & Renewables (Solar/Wind)

Solar crossed 100 GW, on track for 500 GW clean energy; wind-solar hybrids and PLI for modules/batteries accelerating. EV sales up amid FAME incentives.

EV Charging Expansion

Tata Power leads with 40+ cities network, MOUs with IOCL/HPCL/IGL; aims 100,000+ points. Reliance (via petrol pumps, Lithium Werks acquisition) and Adani Total (partnerships) expanding aggressively. Raw materials: Copper wiring (Sterlite Copper, Hindustan Copper), aluminum casings (NALCO, Hindalco), steel structures (Tata Steel, JSW Steel), plastics/polymers (Reliance Industries). Commercial plans: Tata Power/Reliance target nationwide coverage by 2030, tied to EV adoption goals.

Pharma Sector

Pharma grew robustly at 9.9% in FY25, led by 11.6% domestic (chronic therapies, rural penetration) and 18.9% Europe gains, offsetting US moderation to 3-5% in FY26 from pricing erosion and FDA scrutiny. Margins stable at 24-25% with PLI aiding APIs/specialty drugs; R&D at 6-7% focuses on complex molecules. Key stocks: Sun Pharma, Dr. Reddy's (US generics), Divi's Labs (CRAMS), Cipla (domestic/respiratory).

BONUS

IT Sector

IT indices underperformed cyclicals in 2025, with revenue growth slowing to ~4-5% due to US economic softness and tariff uncertainties, though domestic demand grew 7%. For FY26, expect 2-3% overall growth accelerating to 5-6% in FY27 as AI, cloud, and agentic AI stabilise demand; headcount additions turned positive, but margins face AI productivity pressures. Key stocks: Infosys, TCS, Wipro for large-cap stability; emerging AI/cloud plays like LTIMindtree.

Farming/Agriculture Sector

Agriculture sector indices trailed in 2025 amid monsoon variability, but Union Budget 2025-26 boosted with PM Dhan-Dhaanya Yojana, pulses mission, KCC limits to Rs 5 lakh, and MahaAgri-AI policy (Rs 500 cr). Outlook: 8-10% growth from exports ($24 bn target), climate-resilient seeds, and irrigation; risks include weather/policy execution. Key stocks: UPL, Coromandel International (fertilisers), PI Industries (agri-chemicals), Kaveri Seeds, Godrej Agrovet, Chambal Fertilisers.