India’s New Income Tax Act 2025: How CBDT Is Simplifying Tax Compliance

India’s tax administration is quietly preparing for one of its biggest shifts in decades.

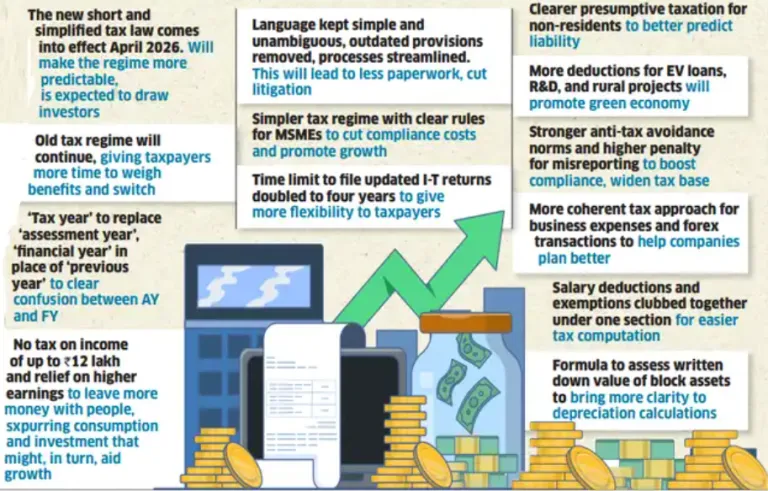

The Central Board of Direct Taxes (CBDT) is steering the transition from the old Income Tax Act, 1961 to the new Income Tax Act, 2025, with a clear goal: make taxes simpler, more digital, and easier for taxpayers to deal with.

Although the new law formally kicks in from April 1, 2026, the groundwork has already begun this year. Rules, return forms, IT systems, and officer training are being rolled out well in advance so that taxpayers don’t face a sudden or confusing switch when the law becomes operational.

Why a new tax law?

The 1961 Act has grown bulky and complicated over time, weighed down by decades of amendments, cross-references, and outdated language. The 2025 law aims to clean this up by removing redundancies and reorganising provisions into a more logical structure.

The result is a leaner framework—fewer chapters, clearer sections, and simpler wording. One of the biggest quality-of-life changes is the introduction of a single “Tax Year”, replacing the confusing “previous year” and “assessment year” system that often tripped up individual taxpayers and small businesses.

What’s changing right now?

CBDT is already redesigning ITR and TDS forms to align with the new law. The focus is on plain language, reduced duplication, and layouts that are easier to understand. These new forms are expected to be released for public consultation well before the law comes into force.

At the same time, backend IT systems are being upgraded, and tax officers across the country are undergoing training so that interpretations of the new law remain consistentand taxpayers receive better guidance during the transition phase.

From enforcement to facilitation

In his New Year message, CBDT Chairman Ravi Agrawal made it clear that the department’s approach is evolving. The emphasis is no longer just on enforcement and collections, but on trust, service, and facilitation.

With greater use of data analytics and automated systems, routine compliance work is increasingly handled by technology. This allows officers to focus more on resolving grievances, guiding taxpayers, and reducing disputes rather than escalating issues prematurely.

NUDGE: encouraging voluntary compliance

A key pillar of this approach is CBDT’s NUDGE framework-Mon-Intrusive Usage of Data to Guide and Enable. Instead of jumping straight to penalties or prosecution, the system uses domestic and international data to gently alert taxpayers about mismatches or omissions.

The impact has been tangible. In its first major campaign on foreign asset disclosures, over 24,000 taxpayers voluntarily revised their returns, declaring foreign assets worth more than ₹29,000 crore and additional foreign income of nearly ₹1,100 crore-a strong case for persuasion over pressure.

What this means for taxpayers and markets

For individuals and small businesses, the shift promises simpler compliance, clearer rules, and fewer grey areas that often led to litigation or confusion.

For investors and markets, a cleaner, tech-driven direct tax system improves predictability and lowers compliance costs-bringing India’s tax framework closer to global best practices and strengthening the overall ease of doing business.

In short, the new Income Tax Act isn’t just a legal rewrite-it’s a reset in how the tax system engages with taxpayers.