Goldman Sachs Gold Forecast $5400: Wall Street Bullish on 2026 Rally Amid Geopolitics

Goldman Sachs has turned even more bullish on gold, lifting its December 2026 price target to $5,400 per ounce as a powerful mix of private and central-bank demand collides with intensifying geopolitical risk. For traders and long-term investors, this call reinforces gold’s status as a core macro hedge in a world of policy uncertainty, de-dollarization, and elevated geopolitical tension.

What Goldman Sachs Is Calling

Goldman Sachs raised its end-2026 gold forecast by $500, from $4,900 to $5,400 per ounce, in a note dated 21 January 2026.

The bank expects central banks to keep buying around 60 tonnes of gold per month in 2026, providing a structural demand floor for prices.

Analysts argue that private-sector “diversification buyers” will hold positions through 2026, effectively lifting the baseline for fair value rather than creating a short-lived spike.

Private Investors Take the Driver’s Seat

After central banks dominated the post‑2022 bull leg, Goldman now sees private investors-wealth managers, funds, family offices and pensions-leading the next wave of demand, particularly via ETFs and allocated bullion.

These allocations are framed as protection against macro policy risk (fiscal deficits, currency debasement, geopolitical shocks), rather than tactical trades, which supports a “sticky” demand profile.

For portfolio construction, this strengthens the case for gold as a strategic hedge: allocations are being justified as long-horizon insurance rather than a short-term momentum bet.

Geopolitics: Greenland, Tariffs And Safe-Haven Flows

Spot gold has already smashed through the $4,800 mark, hitting intraday records near $4,888 per ounce as markets react to tensions between the US and Europe over Washington’s push to gain control of Greenland.

Threats of tariffs on several European countries and hard rhetoric around Greenland have pushed investors out of equities and into safe havens, with gold benefitting from both risk-off flows and a softer US dollar.

Even when tariff threats briefly ease, pullbacks in gold have been shallow, suggesting dip-buying interest consistent with a strong secular bull market rather than a fragile blow-off top.

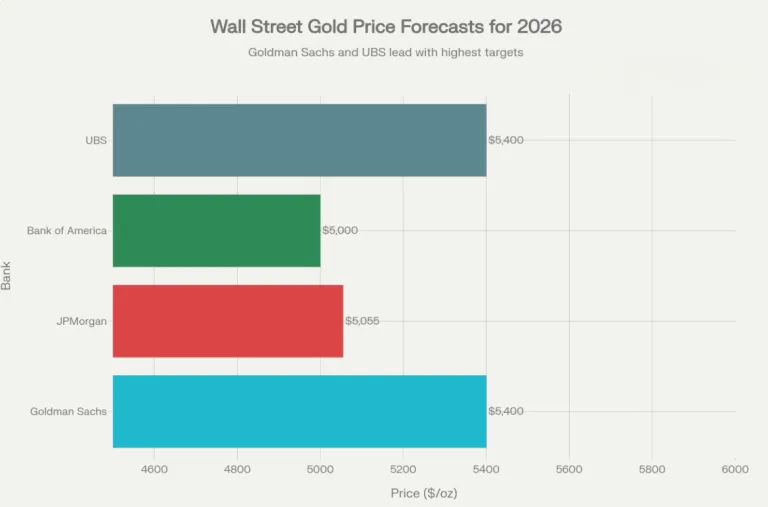

How Other Banks See Gold

Institution | Target / View | Timeline / Context |

|---|---|---|

Goldman Sachs | $5,400/oz end‑2026 (raised from $4,900) | Highest‑conviction long in commodities; powered by private + CB demand |

JPMorgan | ~$5,055/oz average | Q4 2026 average; sees Fed cutting cycle + stagflation fears as key drivers |

Bank of America | Up to $5,000/oz in 2026 | Focus on US fiscal deficits and currency debasement risk |

UBS | Target lifted toward ~$4,900–$5,400 zone | Cites persistent political and financial uncertainty supporting safe-haven demand |

Others (ICBC, MKS) | Upside scenarios above $5,400 | Niche houses flag tail-risk paths toward much higher levels later in the cycle |

What This Means For Your Readers (Traders & Investors)

Macro takeaway: The consensus is shifting toward a structural gold bull market driven by three forces-central-bank reserve diversification, private wealth hedging against policy risk, and recurring geopolitical flare-ups.

For traders: Elevated volatility around headlines (Greenland, tariffs, Fed cuts) will create trading ranges and breakout opportunities, but the dominant trend bias remains up as long as real rates stay under pressure and dips attract institutional buying.

For investors: Strategic allocations to gold (and possibly quality gold miners) now increasingly resemble a core portfolio hedge rather than an optional satellite, especially for those exposed to US and European assets vulnerable to policy missteps.