Understanding Margin and Leverage in Futures Trading: A Complete Beginner’s Guide

Futures markets provide traders with an efficient way to gain exposure to commodities, currencies, equity indices, and other financial instruments with comparatively lower capital outlay. Central to this system are two key concepts: margin and leverage.

Understanding these elements is essential for responsible trading, risk control, and long-term performance consistency.

This guide explains how margin works, the role of leverage, and why disciplined position sizing is fundamental to success in futures trading.

What Is Margin in Futures Trading?

In futures trading, margin refers to the minimum capital a trader must deposit to initiate and maintain a position.

It is important to note that:

Margin is not a cost or fee.

It is a performance bond ensuring that traders can meet potential losses arising from daily price fluctuations.

Margin requirements are set by the exchange based on volatility and risk levels.

Why Margin Is Required

Futures contracts are leveraged products

Price movements can be swift and significant

Exchanges must ensure financial stability and limit default risk

Margin protects both the clearing system and market participants.

Types of Margins in Futures Trading

1 Initial Margin

The minimum amount required to open a futures position.

Example: For a contract valued at ₹10,00,000 with a 10% margin requirement, a trader must deposit ₹1,00,000.

2 Maintenance Margin

The minimum equity that must be maintained after the position is open.

If the equity falls below this threshold, a margin call is triggered.

3 Mark-to-Market (MTM) Margin

Daily profit or loss is settled in cash by adjusting the margin balance based on the closing price.

Losses must typically be replenished immediately.

4 Exposure / SPAN Margin

An additional buffer charged to account for market volatility and risk, ensuring adequate coverage even during adverse moves.

Total obligation = Initial Margin + Exposure Margin (varies with volatility)

What Is Leverage?

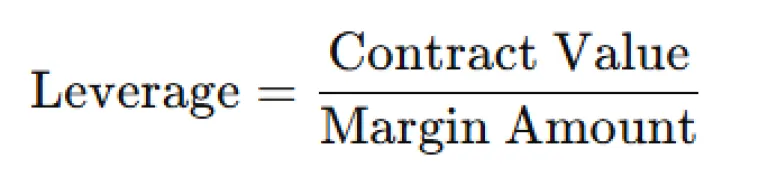

Leverage allows a trader to control a large contract value using a relatively small margin deposit.

Example:

Contract Value = ₹10,00,000

Margin = ₹1,00,000

→ Leverage = 10x

A 1% market movement results in approximately 10% gain or loss on capital : showcasing both its opportunity and risk.

Margin Calls: Why They Occur

If MTM losses reduce account equity below the maintenance margin, the broker will issue a margin call.

The trader must:

Deposit additional funds, or

Reduce or close the position

Failure to respond may result in forced liquidation.

The Importance of Position Sizing

Excessive leverage can rapidly erode capital. Therefore, traders must determine positions based not on maximum permissible exposure, but on:

Risk tolerance

Account size

Volatility of the underlying asset

A widely adopted guideline:

Risk no more than 1–2% of trading capital per position.

This approach ensures sustainability even through adverse market conditions.

Profit and Loss Impact: A Simple Illustration

Underlying Price Movement | P/L on Contract | Impact with 10x Leverage |

|---|---|---|

+1% | +₹10,000 | +10% capital gain |

–1% | –₹10,000 | –10% capital loss |

–3% | –₹30,000 | –30% capital loss ⚠️ |

The same leverage that enhances profits can also accelerate losses.

Essential Risk Management Practices

Best Practice | Objective |

|---|---|

Maintain sufficient margin buffer | Reduce margin call risk |

Use stop-loss orders | Limit downside exposure |

Monitor daily MTM settlements | Prevent compounding losses |

Prioritize liquid contracts | Avoid slippage and execution delays |

Track volatility indicators | Adjust leverage during unstable market conditions |

Professional traders treat risk control as their primary discipline.

Summary Table

Concept | What It Means |

|---|---|

Margin | Security deposit to ensure contract performance |

Initial Margin | Minimum to open a position |

Maintenance Margin | Minimum equity to keep a position open |

MTM | Daily profit/loss adjustment |

Leverage | Larger exposure with limited capital |

Margin Call | Request for additional funds to maintain a trade |

Conclusion

Margin and leverage form the foundation of futures trading. When used judiciously, leverage allows efficient capital deployment and the potential for enhanced returns. However, misuse can lead to rapid capital erosion.

Traders who understand margin requirements, risk mechanics, and disciplined position sizing are better equipped to navigate the futures market responsibly and successfully.

Futures trading offers opportunity, but informed risk management ensures longevity.